The Next SOFI? A Hidden Gem in the Autonomous Vehicle Revolution

Why This LiDAR Innovator Could Be the Turnaround Story Investors Are Waiting For

I called SOFI quite well, and anyone that has followed me knows that at around $6.50, I did many interviews and wrote many articles on it.

When I started covering it:

vs now:

Now, it’s done great, it’s north of $15 which is much higher than my first prediction of $10 by YE 2024, and traded even higher than my H1 2025 prediction of $16, as I wrote about here.

“It’s overbought here for now, but I still think it’s fundamentally undervalued and will be heading to $16. I’d sell in this overbought territory now but would buy back on weakness.”

My TSLA call did well, as I came out saying it was a good buy at $180, which is now over $400, and also my Elliot Investment Management play in Southwest Airlines play ( LUV 0.00%↑ ) is up nicely from my article; where I said it would likely return 44.5% over the next 1-1.3 years, here.

Anywho, I keep trying to hunt and find other unique opporuntities that I like, and one has come across my desk that looks like such.

It’s called INVZ 0.00%↑ or Innoviz Technologies, which went public a few years back via a SPAC transaction, which I generally don’t like.

However; I do like them several years after as the stock from initial SPAC holders and seed shareholders gets cleaned up (err, dumped).

A few SPAC’s have started to do quite well, like GRND which has nearly tripled since it’s late 2023 lows.

Innoviz is an Israeli company specializing in LiDAR sensors and perception software for autonomous vehicles.

They listed at a $1.4 billion valuation, which is typically a made up number with SPAC’s and absolutely any number can be “justified” because they don’t actually have to raise any money at those prices, they just need liquidity, so it’s all fluff as far as I’m concerned.

But, again, we’re nearly 4 years after the fact and it’s been completely cleaned up from then.

Today, the company’s valuation stands significantly lower with 165 million shares out at $0.70, it’s trading at a market cap of around $115 million.

The stock has suffered a serious drop from it’s de-SPAC of $10, to it’s peak of $18, and now under $0.70 as I write this, prospects look dismal…

Or do they!

From what I can tell, recent trading suggests the stock may have bottomed, and analysts and investors alike are now looking at the company with renewed interest.

Is something poised for a reversal?

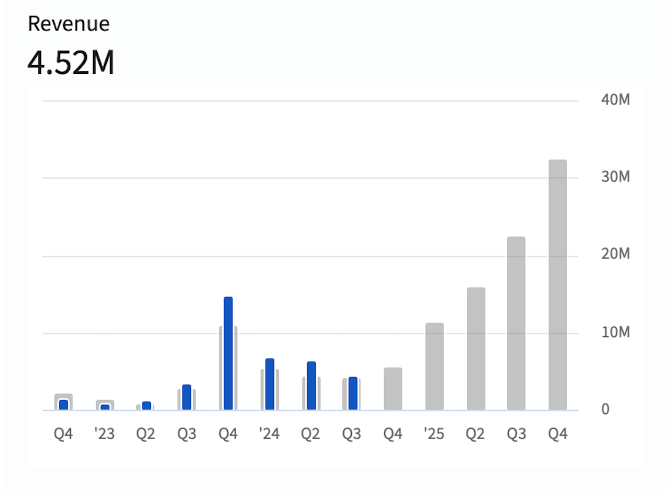

Their revenue has shown ups and downs, but as I like to see it, this is normal for a company that’s young, has just gone public via a SPAC, and is “right-sizing” it’s operations, and/or preparing to scale.

They’re setting the foundation, cleaning things up.

Here’s their revenue and forecasted revenue:

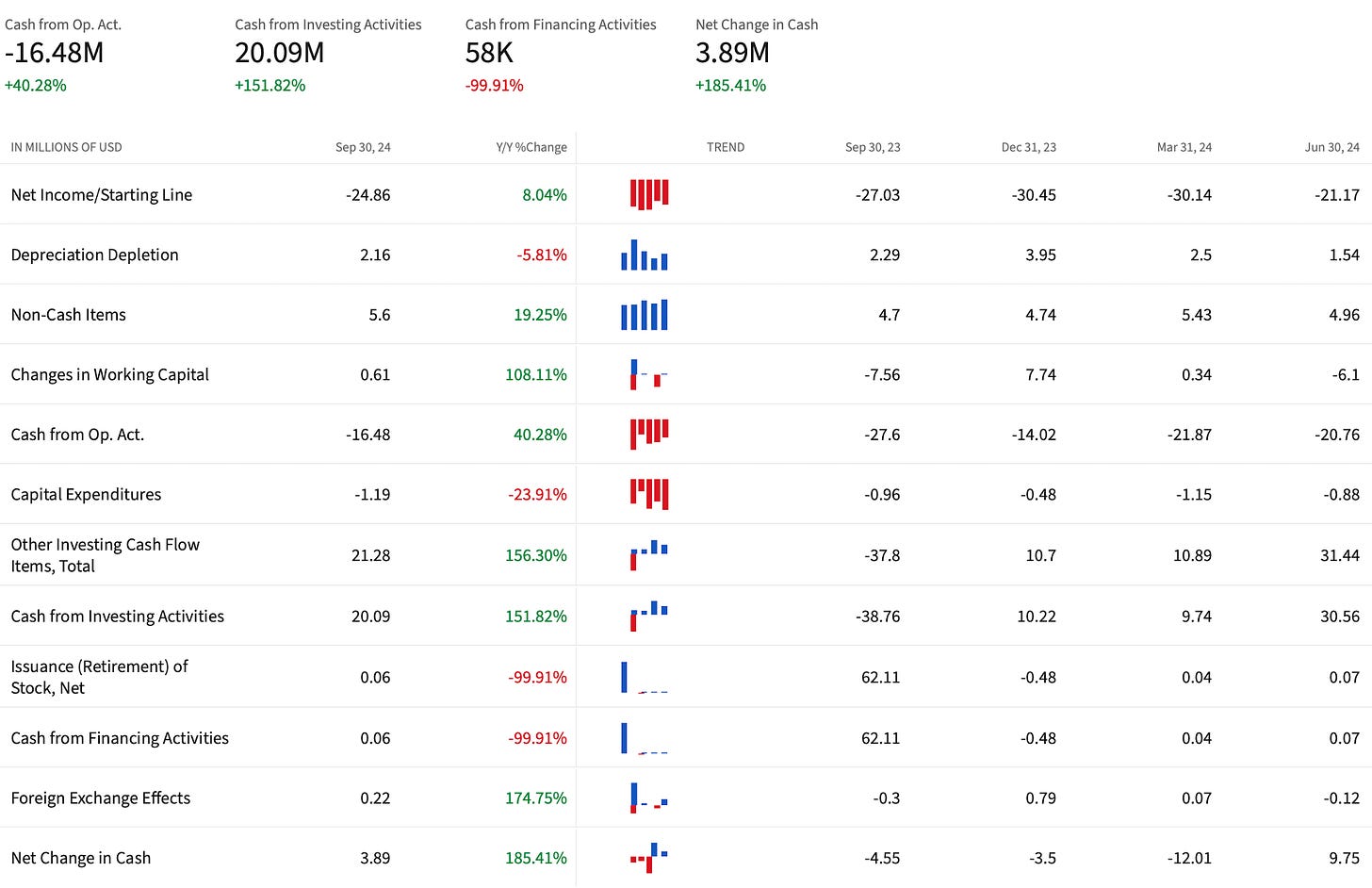

And here’s what I mean by cleaning things up:

Net Income, the most important measure of any financial statement IMO, is improving over time.

They’re cutting their costs, paying down payables, and improving operating cash flow.

The trend is encouraging, with quarterly cash flow deficits narrowing, indicating better operational efficiency and cost management.

The company’s current cash and cash equivalents is approximately $45 million, providing a solid runway for near-term operations.

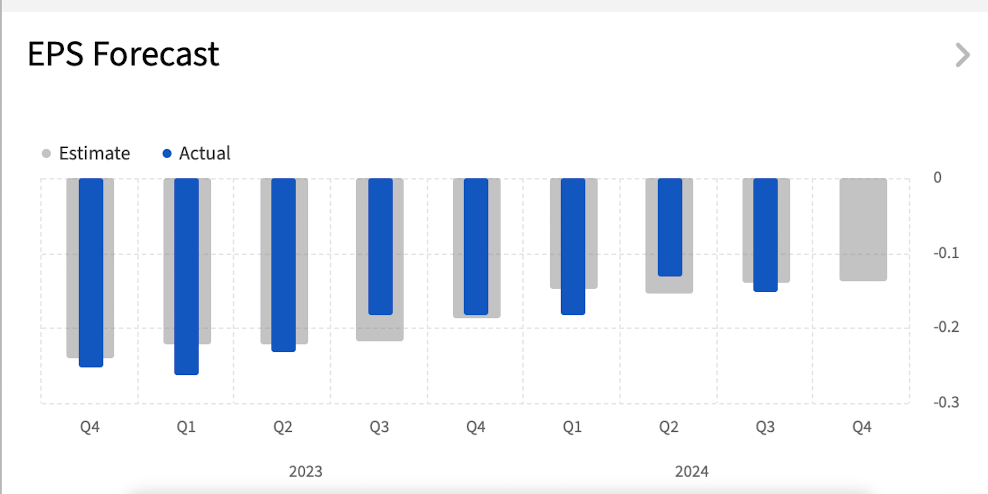

Their EPS remains negative as seen above, but the trajectory is positive as losses per share have decreased YoY and QoQ.

The company has 169 million shares outstanding, with a daily trading volume averaging 2 million.

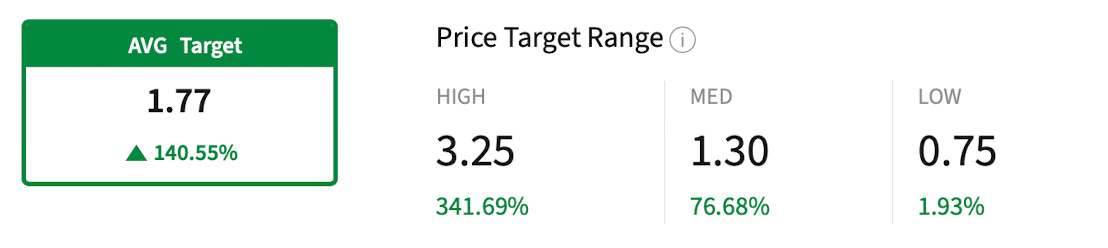

Analysts have issued a range of price targets, with the average target sitting at $1.77 per share, and even the low case above what we’re currently trading at.

If the company can survive these short term hurdles, execute on it’s growth like analysts believe it can, and show improvements across the board with massive scalability, like revenue…

…it’s a “long shot”, but as far as long shots go, it’s one that I’d be willing to bet a small percentage of my portfolio on, as the company represents a classic turnaround story in the making.

Despite its rocky start and substantial shareprice drop, the company is now showing signs of stabilization and growth.

With improving financials, a solid cash position, and a strategic focus on long-term growth, the Company has the potential to reward patient investors.

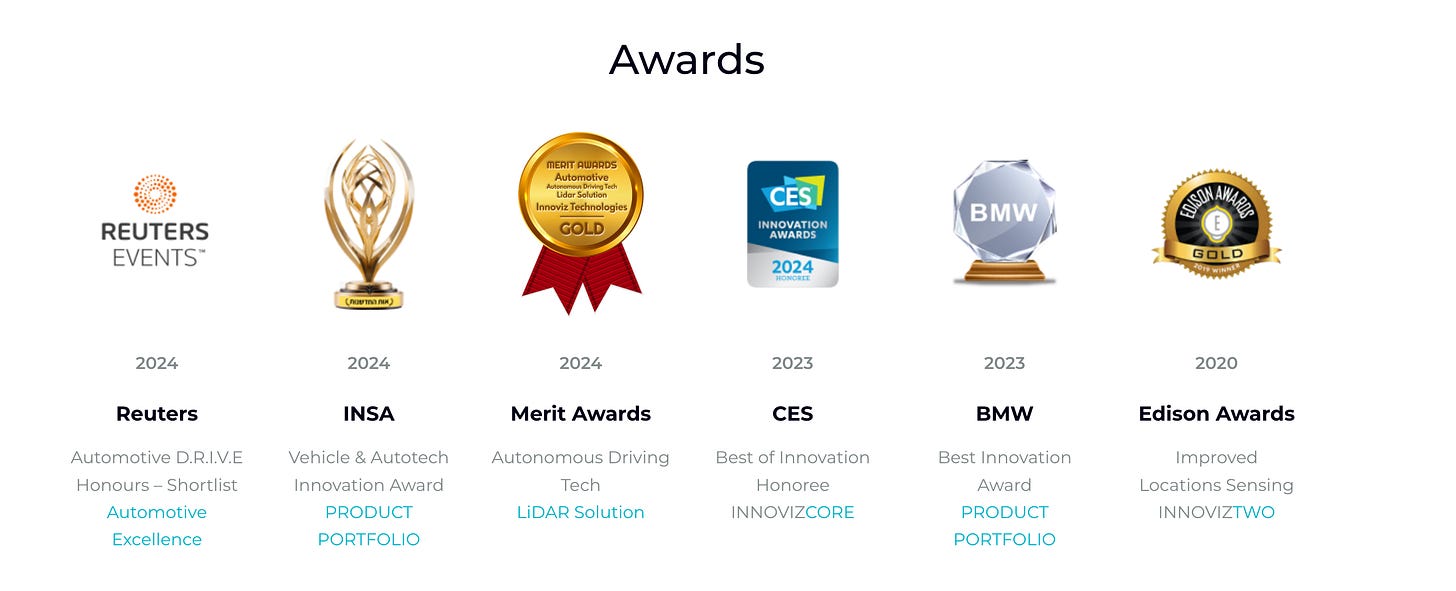

Touching on it’s technology for a minute, this is the stuff I like to see in the market as well, as it’s hard to value the potential.

Supplying LiDAR technology to the autonomous vehicle world is powerful.

The solid-state LiDAR sensors and advanced perception software from Innoviz enable safe autonomy by bringing unparalleled optics, seamless design and cutting-edge technology to market.

I do believe they’re onto something, and we’re onto something with this turn around story. And so do others…

The stock’s apparent bottoming-out provides an attractive entry point, particularly for those willing to bet on the company’s ability to execute it’s above noted plans and while risks remain, the current valuation and positive trends in cash flow, revenue, and operational efficiency suggest a compelling opportunity.

Disclaimer* I’ve started buying and own a small position at the time of writing.

Happy Hunting!