48 Hours, 36 Holes, and 18 Millionaires: An Exclusive Golf Trip Like No Other

Inside a Weekend of Luxury, Golf, and Top Stock Picks with the Elite

It was 10:55 AM when I strolled into the private terminal at GCM (Cayman’s Airport), feeling like a lone ranger in a deserted saloon.

None of my eight friends, who were supposed to be my travel companions, had shown up yet for our 11:00 AM flight.

Flying private is a whole ‘nother level! I chuckled to myself, thinking, "How great is this?"

Then my stomach sank. Worried they had actually left without me, I immediately started dialing the main organizer.

Just as my anxiety was about to take off like our jet, a few of them sauntered in at 10:58, two more at 10:59, and the last, the mastermind behind it all, strolled in at 11:08.

I need to fly private more often….

Unfortunately, the trip to Miami and back for a quick weekend golf outing cost a healthy penny in the Citation X, as steep as a luxury penthouse in Manhattan. Fortunately we all split it.

The eight of us were ready for lift-off.

Heading to the plane, a few of the guys decided walking was out of the question and required the assistance of a golf cart.

After calling them lazy buggers, I started recording this clip:

And just like that, we were off.

It was a 40th birthday weekend golf trip like no other.

I had been invited with a group of guys collectively worth well north of a billion dollars. And that’s what NWC is all about—bringing you, my audience, my readers, my loyal supporters, access. Access to some of the wealthiest people that no one knows about, so you can figure out how to make money following in their footsteps.

I wanted to bring this article to life by asking a bunch of the guys what their top stock picks were.

How can the rest of us make money following the leaders who are in the 1% of the 1%?

And that’s exactly what I did.

In between golf shots and beers, I connected with the elite to bring you exclusive money-making access. Normally, I would have this paywalled, but as I start out, I want to show you the kind of content you’ll be getting in the future.

So let’s dig in...

First of all, I promised to keep the identities of all the guys secret, as many are private.

As the old saying goes, "I'd rather be rich than famous!"

Next, I didn’t get to chat with everyone about this, but I’ve narrowed down my top five or so favorite conversations around the topic.

“So what’s your favorite stock right now, anything on your radar?” I got right into it.

The first guy I spoke to about it, without any hesitation, said, "I don’t do stocks. All my deals are private."

(Having worked with public companies and on my own deals for years, I get it—I get all the headaches.)

So I immediately said, "I don’t blame you! Public companies are like a minefield."

But I pushed him, and he said, "Okay, my favorite stock pick is a ... stock car." 😂

Okay... after a chuckle, I realized this wasn’t going anywhere.

Onto the next. I confidently asked, “So, are you watching any stocks now? What's on your radar if you had to pick one?”

"FORA on the TSX!" was the next answer, with no hesitation.

Interesting.

A new company I had never heard about, but I will have to learn about and follow to see how it performs.

VerticalScope Inc. operates a network of over 1,200 community websites focused on specific interests such as automotive, powersports, outdoor activities, home, health, and technology. The company enables users to share expertise, ask questions, and engage with like-minded enthusiasts. VerticalScope offers unique advertising solutions targeting its extensive and passionate user base, which includes over 55 million registered members and 101 million monthly active users. Headquartered in Toronto, the company also has offices in the U.S., Estonia, and the Cayman Islands.

Next up, after a few more holes of golf and a few more John Daly’s, I was ready to ask my next person.

"SOFI," he responded. "SOFI Technologies on the NASDAQ."

Now, full disclaimer: I actually own SOFI in my safe money portfolio. So again, this is not an endorsement—do your own due diligence. But a great pick for the next 3-5 years, he said.

Today it’s just over $7.00, so we’ll keep an eye on it and see how it performs.

SoFi Technologies, Inc. (commonly known as SoFi) is a prominent American financial technology company that offers a wide range of financial services. Founded in 2011, SoFi's mission is to help people achieve financial independence and reach their financial goals by providing comprehensive financial products and services through an integrated digital platform.

After finishing 18 holes, I was ready to head for dinner.

We had the most incredible steaks at the hotel restaurant at Trump Doral, which were truly delicious, like a symphony for the taste buds.

Check out this menu

Next, I was ready to ask my fourth person their top pick.

This time, a fellow in his early 50s responded with Wayfair, or W, on the Nasdaq.

Now, I think we all know enough about Wayfair, but he seemed to think they’re just getting started - they’re incredibly cheap relative to their peers, have a large percentage of the online furniture market, and have only good things ahead.

“As of the most recent data, Wayfair owns approximately 33.4% of the online furniture market. This makes Wayfair the largest online-only home furniture retailer in the United States. For comparison, Amazon holds the second-largest share with about 29.7% of the market. The combined market share of these two giants underscores their dominance in the online furniture retail space.” - ChatGPT

We’ll have to keep an eye on this one!

Ready for bed, I wanted to hit the hay relatively early for our early golf game in the morning. We had another 18 holes to play, and it was hot, with thunderstorms looming.

Fortunately, the weather held off, and held off just long enough for our buddy to absolutely nail a hole-in-one on the 11th hole—178 yards!

Like threading a needle in a hurricane... ⛳

Okay, back to my task.

Next, I asked one of the guys I was paired up with, "I’m writing a little article on everyone’s favorite stock picks. What’s yours?"

Now, this fellow is the real deal. He runs a multi-hundred-million-dollar portfolio for clients, so he knows his stuff.

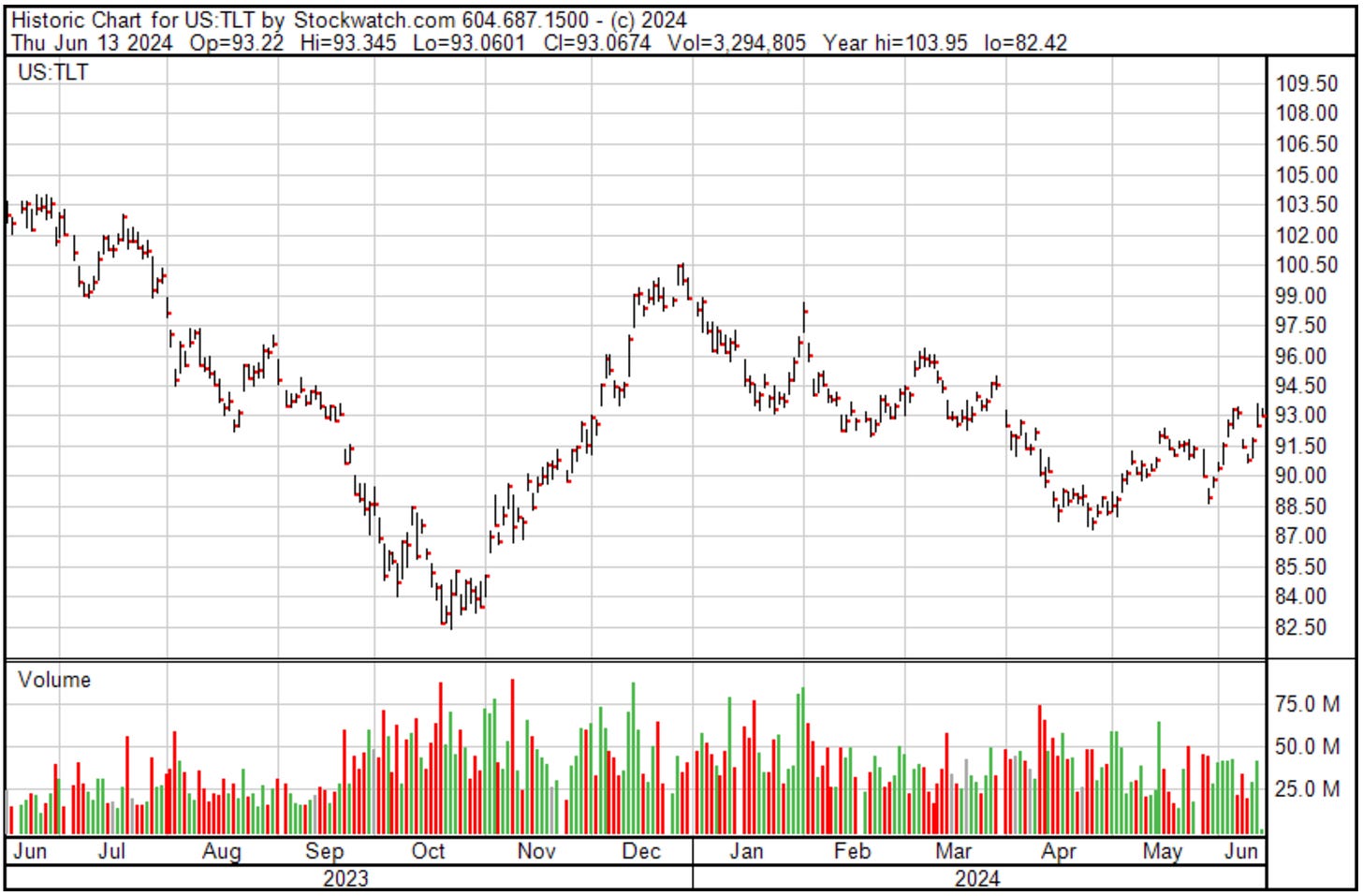

"We have one-third of our portfolio short the TLT right now," he said. He’s either long or short the TLT at all times.

Now that’s an interesting trade from a sophisticated PM.

I don’t recommend shorting unless you really know what you’re doing. And in this case, he does. Again, an interesting trade but I probably wouldn’t be executing on this one.

Golf was wrapping up for the day, and another 18 holes had me very exhausted.

One more fun dinner with the gang, and then back home I go tomorrow.

Named one of Ocean Drive’s Best Seafood Restaurants in Miami in 2021 and featured in the Absolute Best of South Beach by PureWow in 2020, Milos was the choice for dinner. With incredible assortments of all types of seafood, it was a feast for Neptune himself.

This was my last chance to ask anyone what their top stock picks were.

This time, I sat beside another younger fellow, probably in his late 30s or very early 40s.

And again, I was hit with FORA on the TSX. These guys clearly know each other.

So that’s it, folks—a few top stock picks from a few highly sophisticated, extraordinarily wealthy investors.

FORA, SOFI, W, TLT (Long or short) 4 interesting picks from a few very interesting guys.

We wrapped up dinner, headed back to Trump Doral for a good sleep, and the early morning flight back home had me giddy with excitement for the next jet ride.

I hope you enjoyed this article, and let me know in the comments if you want more of this type of content.

All the best,

Danny