Tesla's Financial Ballet: Navigating High Stakes and High Hopes

The Electrifying Tug-of-War Between Bulls and Bears

In the world of investing, the dance between bulls and bears is as old as the markets themselves.

Read the full article or watch the video here.

Tesla TSLA 0.00%↑, the electric vehicle powerhouse led by the one and only Elon Musk, often finds itself at the heart of this financial ballet.

As of late May 2024, Tesla’s short interest stands at 101.3 million shares, a figure that has caught the eyes of many investors and analysts alike.

Short interest, for the uninitiated, is a measure of the number of shares that have been sold short but not yet covered.

It’s an investors way of betting against a stock or a company.

When investors short a stock, they borrow shares and sell them, hoping to buy them back at a lower price.

It’s a high-stakes game, akin to predicting a rainstorm on a sunny day.

For Tesla, this high short interest is a testament to the divided sentiment surrounding the company.

Despite its pioneering status in the electric vehicle market, Tesla has always been a polarizing stock.

Bulls see it as the future of transportation, while bears view it as an overvalued gamble.

Tesla's current Price-to-Earnings (PE) ratio of approximately 46.98 to 53.7 is significantly higher compared to most traditional vehicle manufacturers, but more comparable to high-growth tech companies.

Most traditional automakers have much lower PE ratios. For instance:

Ford: 7.69

General Motors: 6.67

Toyota: 9.61

Honda: 8.48

Nissan: 6.54

These lower PE ratios suggest that traditional automakers are valued more conservatively by the market, reflecting their mature status and more stable, but slower growth prospects.

High-growth tech companies tend to have higher PE ratios due to strong future growth expectations. For example:

Amazon: 73

Alphabet (Google): 27

Apple: 32.1

Tesla's PE ratio places it closer to these high-growth tech firms, indicating that investors are betting on Tesla's significant future growth and innovation potential in the electric vehicle and renewable energy sectors. (And AI and Robotics, more to come on that below)

Among EV manufacturers, Tesla also stands out with a relatively higher PE ratio:

Li Auto: 68.4

XPeng: -5.39

NIO: -2.38

BYD: 34.9

This comparison highlights Tesla's more established profitability and market position compared to many of its EV peers, which are still in earlier growth stages and often not yet profitable.

Now, to put Tesla’s short interest in perspective, let’s compare it with other automakers.

General Motors GM 0.00%↑ and Ford FORD 0.00%↑ have short interest percentages of 5.11% and 3.31% respectively.

While Tesla's short position is 101.3 million total shares, or just over 3% of it’s float, the total value represents over $18.63 billion, making it one of the most shorted stocks by dollar amount.

Despite this significant short interest, the percentage of float short is still considered low compared to bearish thresholds of 10% or higher.

Meanwhile, newer entrants in the EV market, like Nikola NKLA 0.00%↑, have a massive 19.70% of their shares short, but then again, they are trading at $0.35 down from a high in 2020 of $90 and change.

This juxtaposition paints a vivid picture: while traditional automakers face their own share of skepticism, Tesla’s position is uniquely charged with both optimism and doubt.

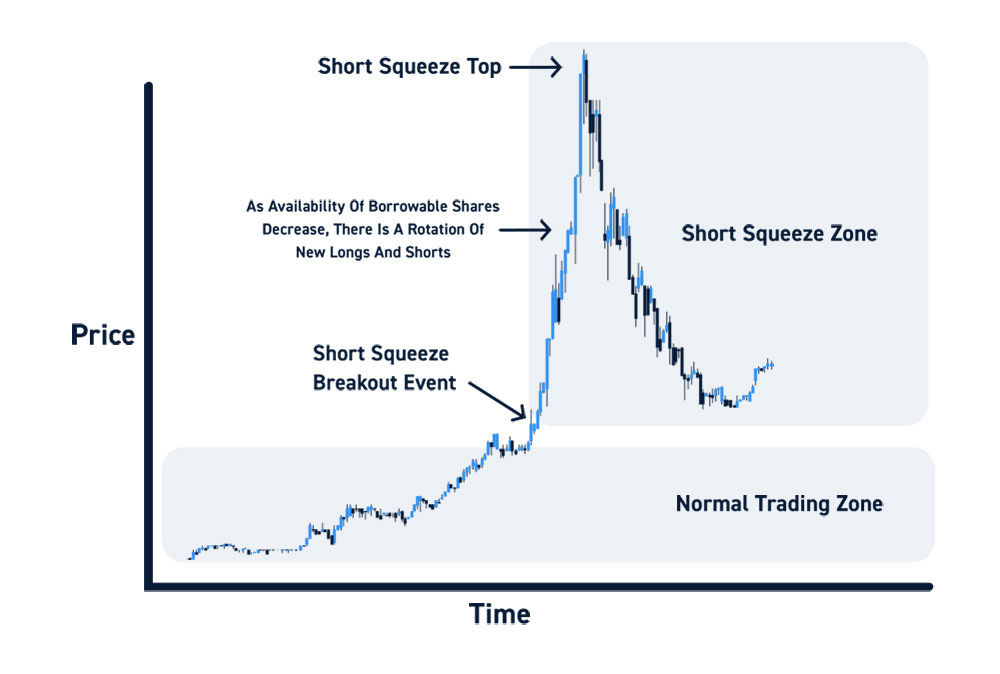

One of the most dramatic outcomes of high short interest is the short squeeze.

Picture a crowded theatre where everyone simultaneously realizes there’s only one exit – chaos ensues.

In the stock market, a short squeeze occurs when a heavily shorted stock’s price starts rising, forcing short sellers to buy shares to cover their positions, which in turn drives the price even higher.

I won’t mention the time I saw a broker, who will remain unnamed, crying at Cactus Club in Vancouver after shorting a gold company that unexpectedly hit a massive coal discovery, causing the stock to soar from mere pennies to +$20.

Tesla has been no stranger to this phenomenon.

In the past, significant short interest has sometimes led to sharp price increases, much to the chagrin of bearish investors.

Understanding the potential for a short squeeze is crucial for investors, as it can lead to rapid and unexpected price movements.

Institutional investors also play a pivotal role in the short interest landscape.

Major players like Citron Research (Andrew Left), Walleye Trading LLC, and Jane Street Group have been known to take significant short positions or short positions in Tesla.

These institutions often have sophisticated strategies and access to vast resources, allowing them to influence market sentiment and movements more than the average retail investor.

So, what does this all mean for Tesla and its investors?

High short interest can be a double-edged sword.

On one hand, it signals skepticism and potential downside risk. On the other, it can set the stage for explosive upward movements if a short squeeze occurs.

For investors, the key is to stay informed and agile.

Keep an eye on short interest trends, understand the broader market sentiment, and be prepared for volatility.

Tesla’s journey is like a thrilling dance, full of unexpected turns and leaps. Whether you’re a bull or a bear, one thing is certain: the show is far from over.

In my opinion, Tesla's significant pivot towards robotics and AI makes shorting the stock a risky move.

Elon is a wild man, and any number of tweets or comments at a conference can throw caution into the wind and spark a massive rally.

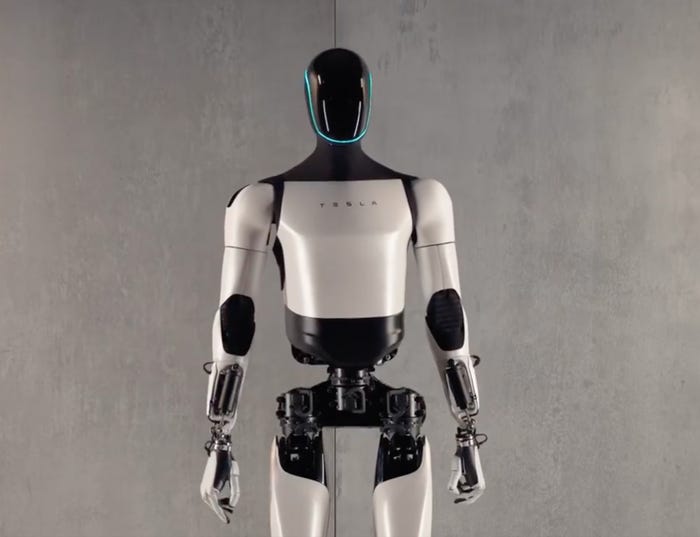

On the robotics front, Tesla has launched its ambitious project, the Tesla Bot, also known as Optimus.

The humanoid robot is designed to perform repetitive and mundane tasks, freeing humans from dangerous and monotonous labor.

Unveiled in 2021, Optimus is equipped with advanced artificial intelligence systems, cameras, and sensors, leveraging Tesla's expertise in autonomous driving tech.

The robot stands at about 5 feet 8 inches and weighs 125 pounds, with a carrying capacity of 45 pounds. Its potential applications span various industries, including manufacturing, logistics, and home assistance, showcasing Tesla's vision of integrating robotics into everyday life to enhance efficiency and safety.

In a recent interview, Elon said Optimus could add $25 trillion to Tesla’s market cap.

He emphasized the robot's vast potential, suggesting that if Tesla captured even a 10% share of the humanoid robot market, producing and selling each robot for $20,000 with a $10,000 profit margin, the company could generate $1 trillion in annual profit.

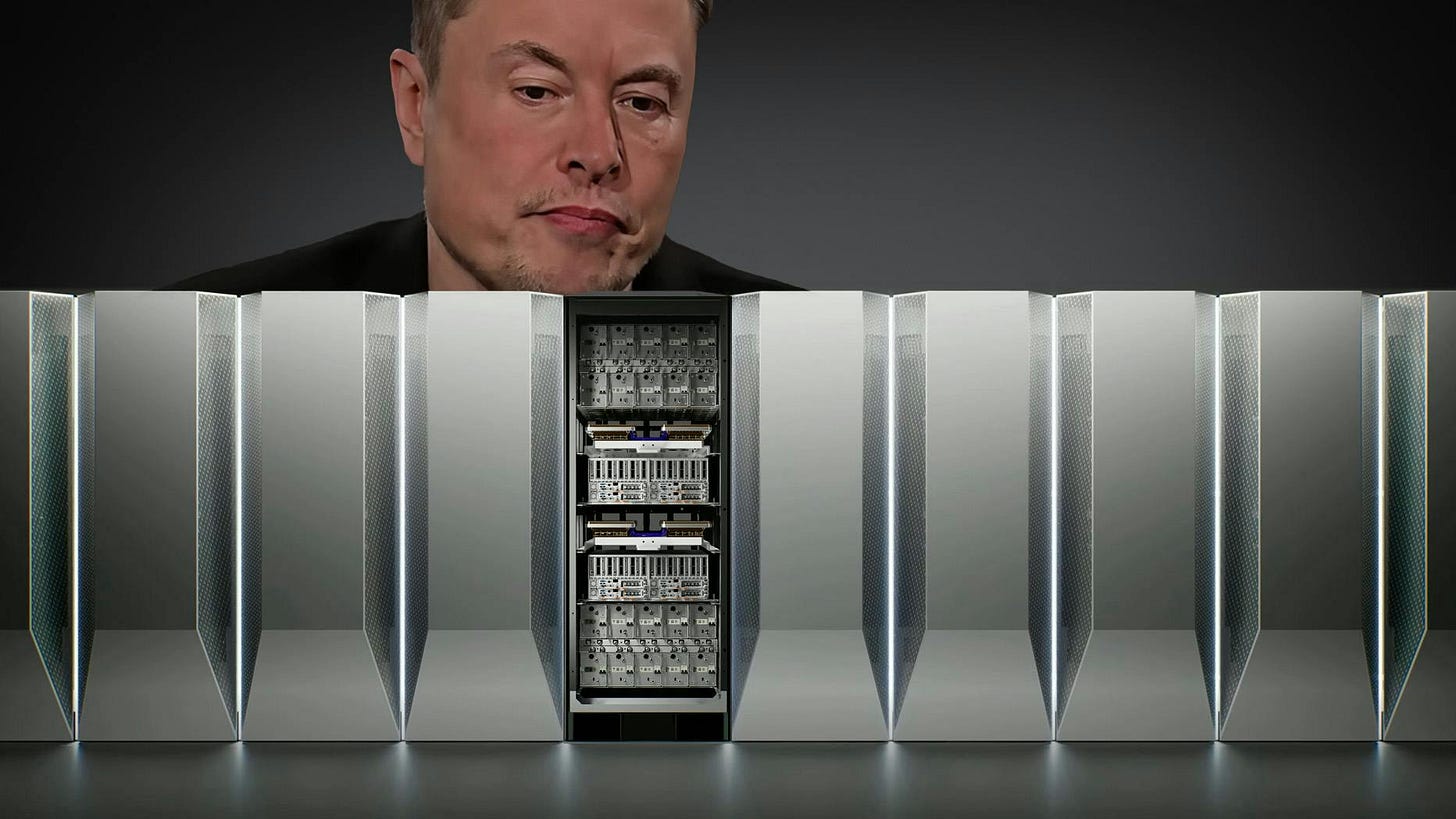

Then there’s the AI side.

Tesla is heavily invested in artificial intelligence, primarily to advance its self-driving technology.

The company's AI initiatives are spearheaded by its proprietary neural network, which powers the Full Self-Driving (FSD) system in Tesla vehicles.

This system utilizes deep learning algorithms and vast amounts of data collected from Tesla's fleet to improve real-time decision-making and driving capabilities.

Tesla also developed the Dojo supercomputer.

Designed to process massive amounts of video data and enhance the AI's learning curve, the company's AI strategy aims to achieve full autonomy, reducing the need for human intervention and setting new standards for safety and convenience in transportation.

That said, I certainly wouldn’t be shorting Tesla.

I'd lean more towards the bull side of the equation, aligning with the likes of Cathie Wood on this one.

Cathie, the CEO of Ark Invest, has made a highly optimistic price prediction for Tesla.

In a recent update, Ark Invest set a new price target of $2,600 for Tesla by 2029. This prediction is heavily based on the aforementioned diversifications, along with the robotaxi initiative, which focuses on the development and deployment of autonomous vehicles for ride-hailing services.

At the time of writing, Tesla closed at $182.66. If Cathie is right, that's a potential return of 1,323%.

In the high-stakes world of investing, Tesla remains a focal point of both excitement and controversy.

The company's high short interest reflects the divided sentiment among investors, with bulls betting on its innovative future and bears questioning its valuation.

Tesla's ventures into robotics and AI, alongside its established dominance in the electric vehicle market, highlight its potential for significant growth.

However, the high short interest also poses the risk of dramatic price swings, particularly through short squeezes.

For investors, staying informed and adaptable is key.

As Elon continues to drive Tesla into new technological frontiers, the dance between bulls and bears is sure to remain a captivating spectacle.

I’m not long Tesla, but I’m certainly thinking about it - and I certainly wouldn’t be short given everything Elon is working on.

Happy Hunting!