Uranium Bulls: Meet the World’s Largest Uranium Exploration Company

Why there has never been a better time to be aggressive in this space …

In the commodity sector, there are classic “Econ 101” stories unfolding all around us of supply not meeting demand.

That’s especially true with uranium, which is the “fuel” used by nuclear power plants.

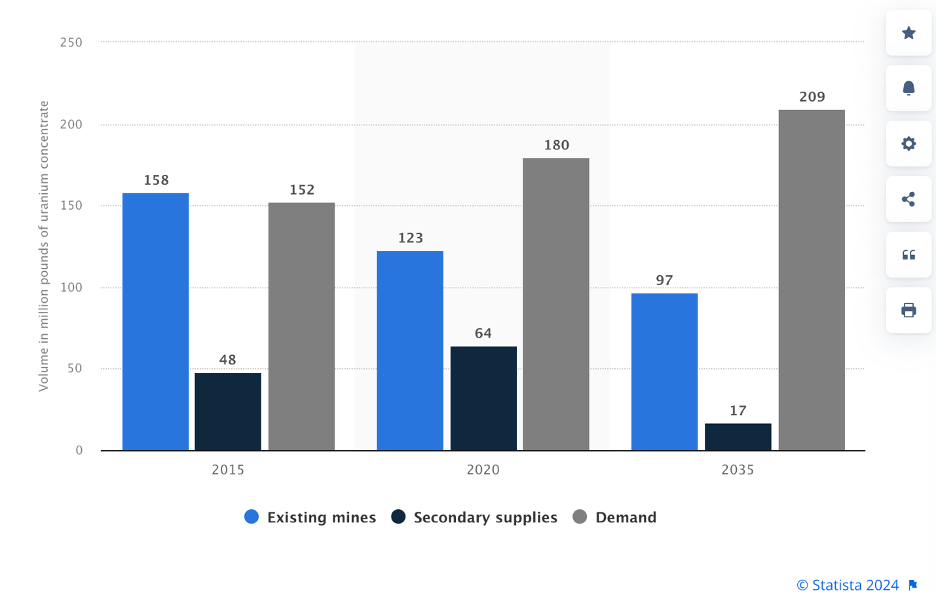

As more countries have turned to nuclear power, you can see in the chart below how demand has been ticking higher since 2015. By 2035, supply won’t be anywhere close to meeting demand:

Although trading at roughly $90 per pound now, the price topped $100 earlier in the year (a 16-year high). And as supply keeps dwindling while demand keeps climbing, dusting off those Econ 101 textbooks tells us what’s going to happen to prices.

That’s why I sat down with Troy Boisjoli, the CEO of Atha Energy Corp. (TSX-V:SASK).

Running the world’s largest uranium exploration company, he has a front-row seat to how all of this is playing out. Troy says there has never been a better time to be aggressive in the space than right now; in the interview, you’ll see how he backs up that claim.

I have a quick breakdown of the topics we discussed and the corresponding timestamps of those topics for your convenience:

0:20 – Troy Boisjoli shares his background.

2:53 – Get to know Atha.

7:46 – Why Troy took on the CEO role.

10:23 – What’s driving supply and demand.

12:37 – Uranium, nuclear power, and the AI industry.

15:18 – The nitty gritty behind Atha’s funding rounds.

18:30 – Breaking down the share structure.

20:52 – How proceeds will be used.

23:45 – Plans for the next three to five years.

26:40 – Final thoughts.

If you want to learn more about Atha, you can check out its website here.

All the best,