📈 The Remarkable Rise of SOFI: From $6.52 to $11.50 in 119 Days

Why SoFi is Poised for Continued Success

I recorded my first interview on SoFi in June (of this year) with

, where I talked about my top predictions for the second half of 2024.On July 3rd, that interview was published:

I said it was a “wild one”, as far as price predictions go, as I said it would be north of $10 by year end. As it’s now over $11, they deserve a nice update, similar to my TSLA update earlier this week.

Enjoy!

✅ SoFi Closing Price Day of the Published Interview (July 3): $6.52

✅ SoFi Price Today: $11.50

✅ Return: 76%

✅ Days for return: 119 days.

Now, not all my stock picks will do this; this is just one example.

(Although TSLA, one of my other favorites, is up similar amounts in similar time frames.)

Still, I’m more cautious than one might expect from such a nice run-up in such a short time period.

However, I do still see great value with SoFi, and while I suggested taking some off the table with a further (very short) interview (with

, here) of 30-50%, to re-acquire the position on weakness, the stock has continued to run.This leads me to: I’m a big fan of averaging UP.

Again, we are wealth builders, not wealth killers, and one of the hardest things to do for most investors is average UP.

Everyone talks about averaging down…

“Don’t be a clown, average down!” as we used to say.

But my best trades, my most successful investments, have always come from averaging up.

You let the winners run, add to your position, and cut your losers short when they are… well, losing.

SoFi is a great example of this.

I thought selling 30-50% at $11 would be a good call, and I still think it could be.

You buy that dollar amount back at a lower price point when (if) it dips, creating a larger position overall, and “averaging up.”

This is how I’ve made the most money over the years with trading: letting the winners run and continually adding to those positions.

Anyway, now that we are up 73%, I think this strategy makes sense.

Buy more on weakness.

I do believe the next major move will be $16 in the next 6-8 months, and I was early on this call in that I said it would happen before Dec 31st, but I do believe with the fundamentals in check, continued execution by the management team, and the broader markets holding together, we can see $16.

I’ll reassess fundamentals as we go, but I think there’s a strong case for it.

Here’s why.

Members growth, products growth, revenue growth, and earnings growth…

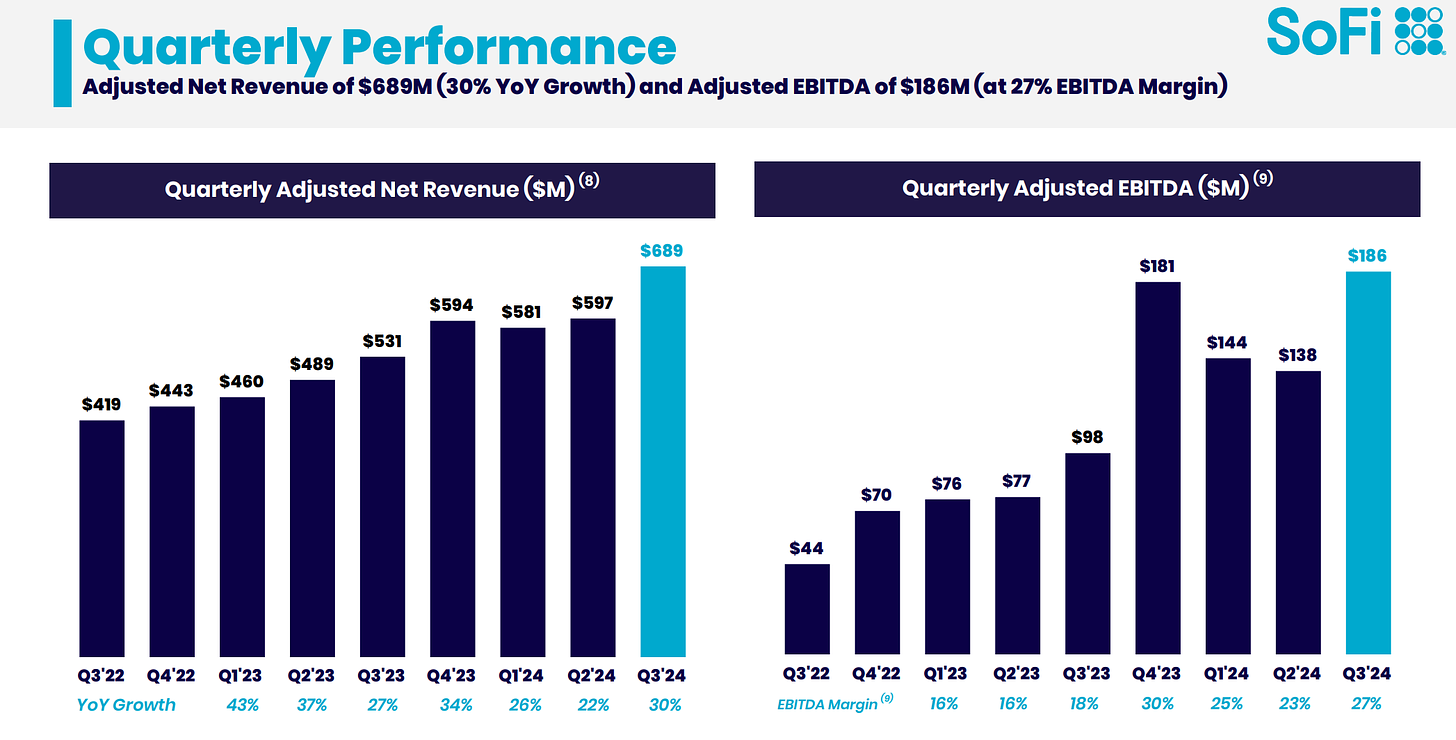

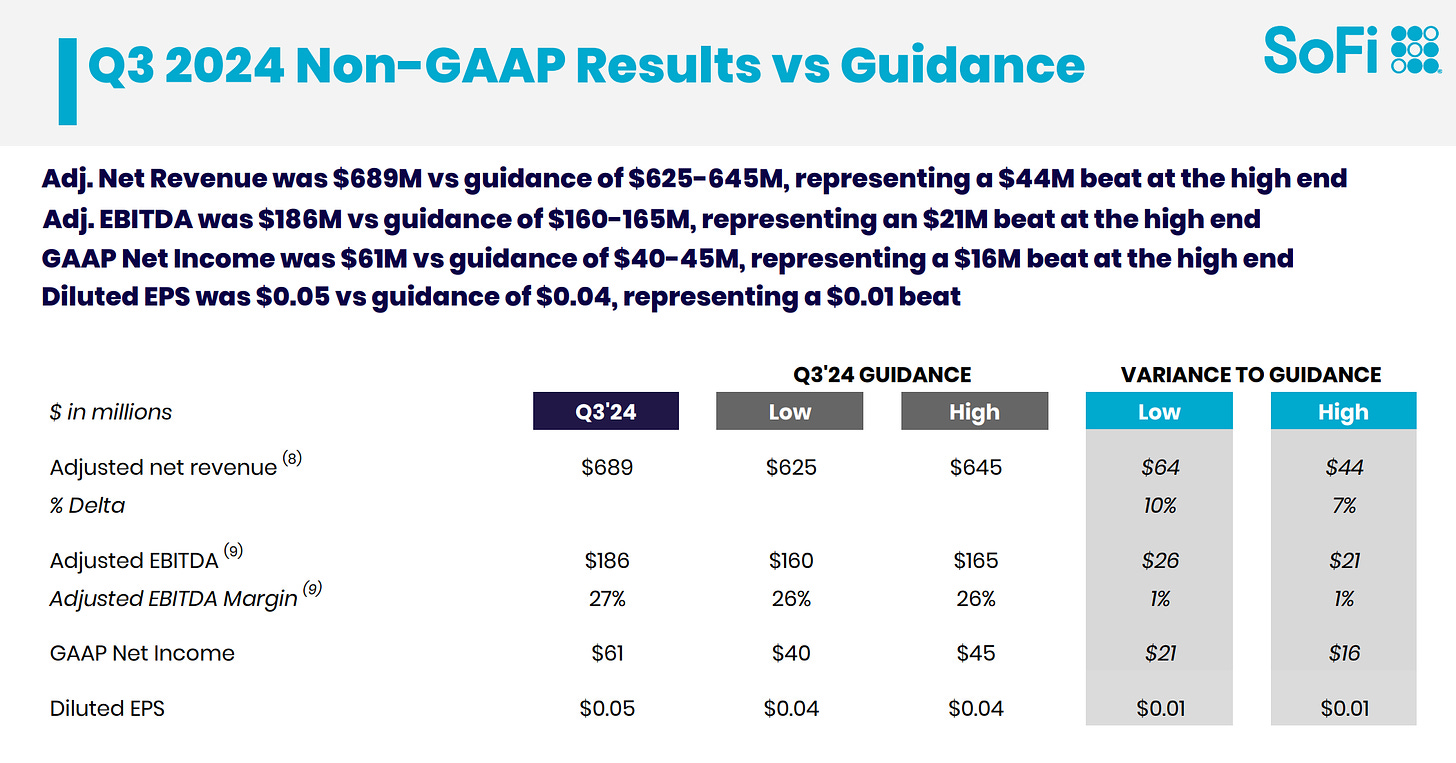

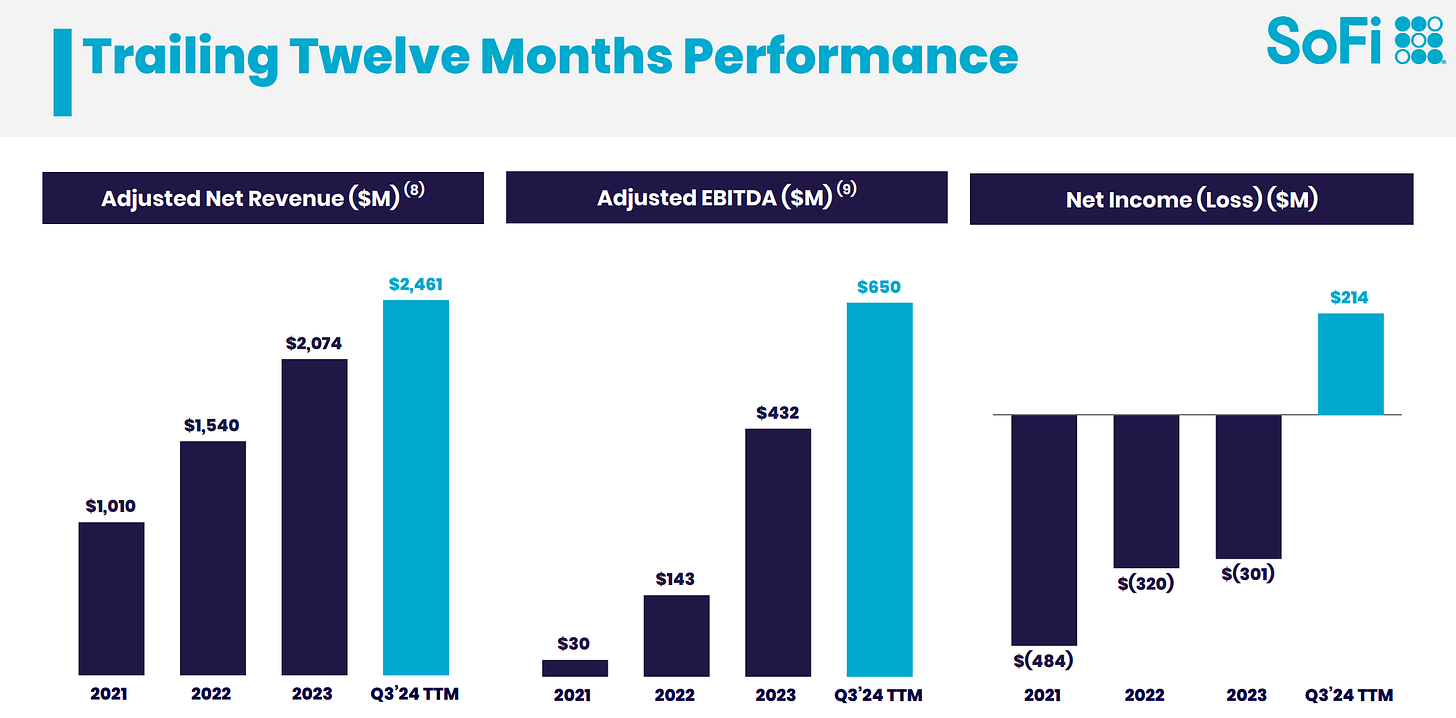

A major catalyst for SOFI's impressive run was its Q3 earnings announced yesterday, where revenue jumped to $697.1 million - a 35% jump from the same period last year.

This performance not only exceeded analysts' (and the company’s own guidance) expectations but also sparked confidence from investors.

The report highlighted SOFI's remarkable turnaround to a net income of $60.7 million, a massive contrast to a loss of $276.9 million last year and an equally impressive beat on Q3 guidance.

This is also massively important:

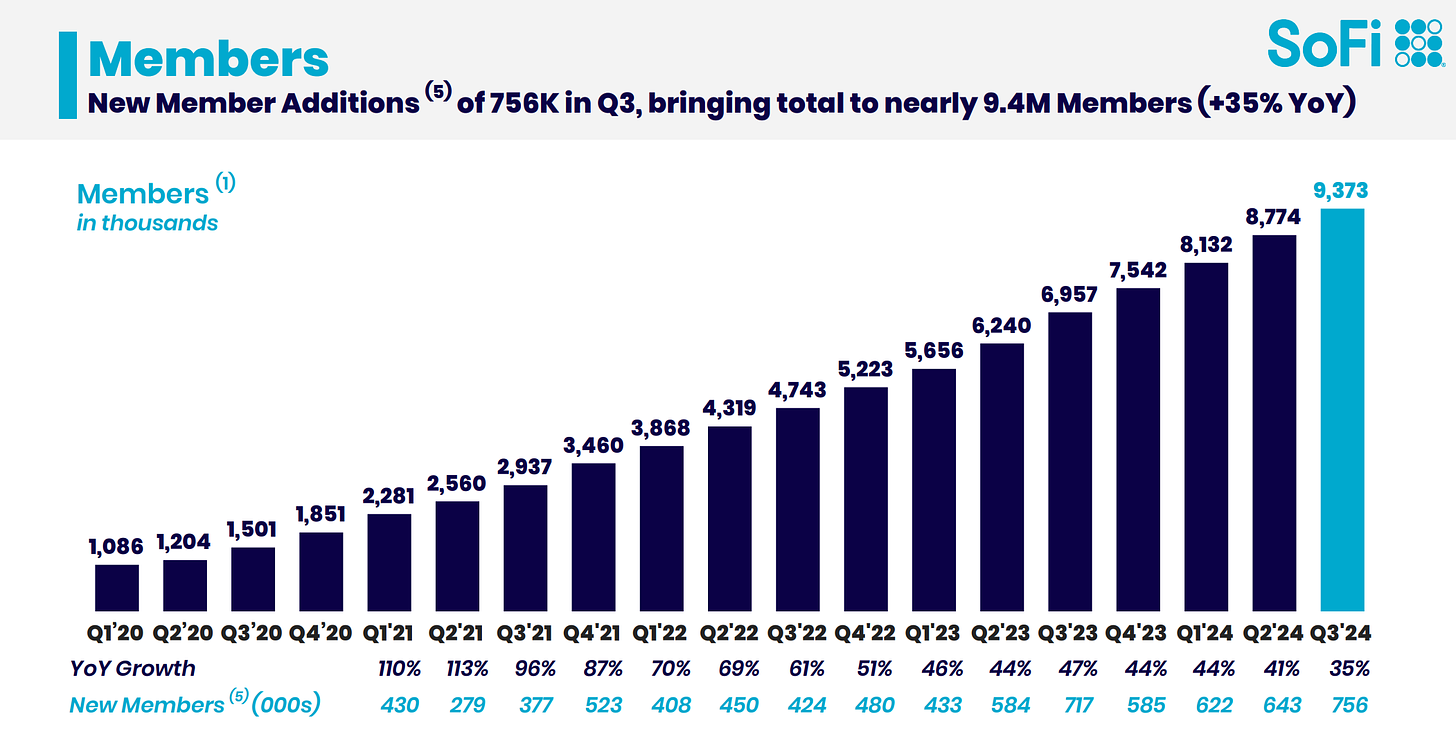

Another significant factor has been its relentless drive to expand its user base.

With over 9.3 million members, the company is opening its door to sell products cross-platform, which means revenue and net income will only grow quicker and quicker as members grow.

A classic self fulfilling prophecy!

This will provide a huge to boost average revenue per user and also cultivates customer loyalty, crucial for long-term success.

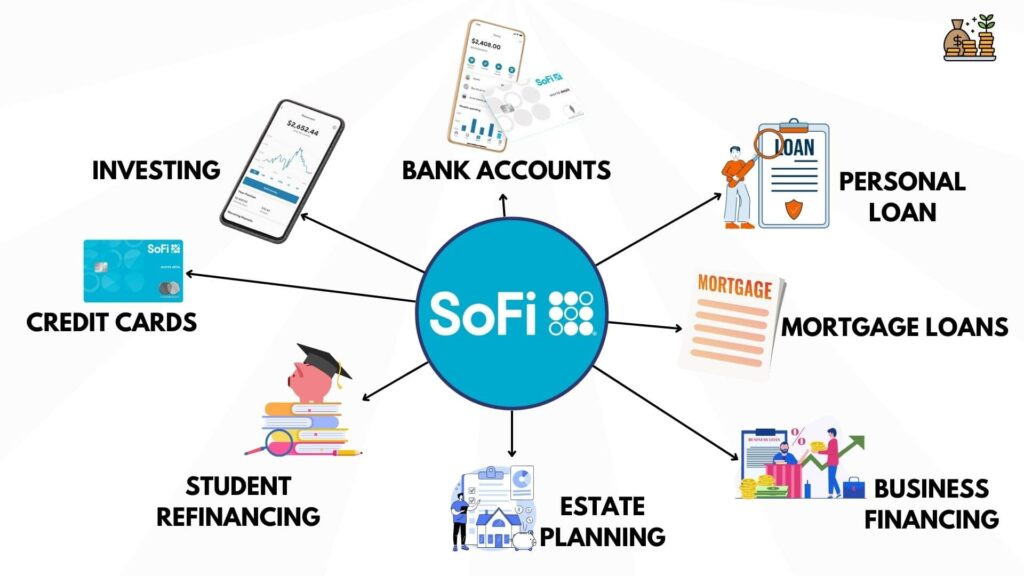

The company has successfully branched into every aspect of TradFinTech, if that’s even a word. (Hopefully some of you are still reading)

This expansion will continue attracting a broader demographic, appealing to both trad consumers and the tech-savvy millennials and gen-z'ers.

They also just locked in a $2B loan from Fortress Investments, read more about that here.

Or if you don’t want to, here’s a tidbit

The agreement will expand SoFi’s capabilities in its loan platform business, where the company refers pre-qualified borrowers to loan origination partners as well as originates loans on behalf of third parties.

They are crushing it.

Leading this growth is CEO Anthony Noto, whose vision emphasizes creating a comprehensive one-stop-shop for all financial needs - a concept that clearly resonates well with consumers.

His experience in both technology (during his time at Twitter) and finance (at Goldman) provides the company with a fantastic leader with an impressive background and skillset to run this business.

“SoFi’s loan platform business is an important part of our strategy to serve the financial needs of more members and diversify toward less capital-intensive and more fee-based sources of revenue,” said Anthony Noto, CEO of SoFi. “We’re pleased to see continued strong demand for SoFi’s loan platform business. Fortress’ collaboration, seamless execution, and appreciation of the platform's value proposition makes them an exceptional partner.”

Fun Fact: Do you know what “SoFi” stands for? Social Finance is the answer.

Moving on… by investing in its infrastructure, SOFI has enhanced it’s user experience and streamlined operations. This means faster and more efficient services - a critical factor for retaining customers in a competitive market.

They’ve significantly revamped their marketing strategies, as well, focusing on its unique selling propositions, like no fees and competitive interest rates and as you’d expect with a Social Finance company, they also have launched Social media and influencer partnerships; which is clearly working.

Now that all the above is taking place, analysts' recent upgrades have propelled the stock even further (IMO), with revenue exceeding estimates by 8.8% and EPS surpassing estimates by 25%.

But, as we know, what’s most important about any company is where they’re going. Any SOFI is proving out it’s remarkable ability to execute and continue doing so.

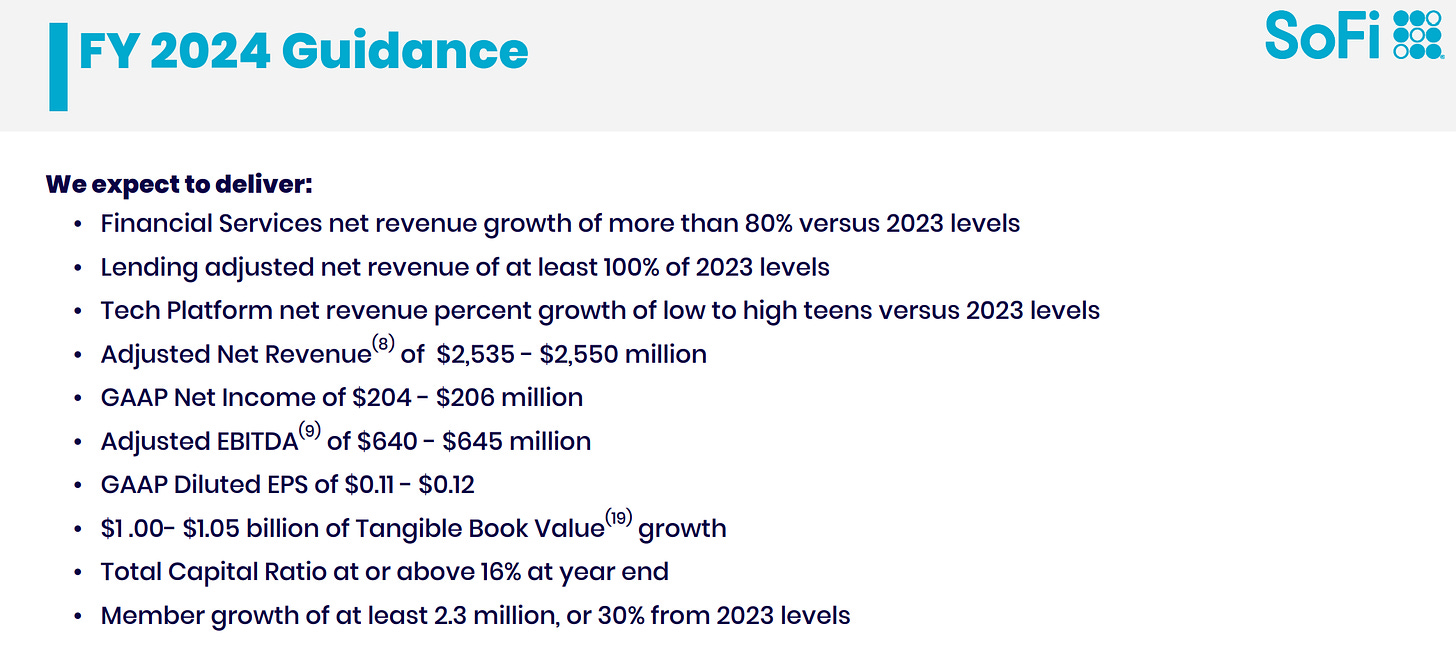

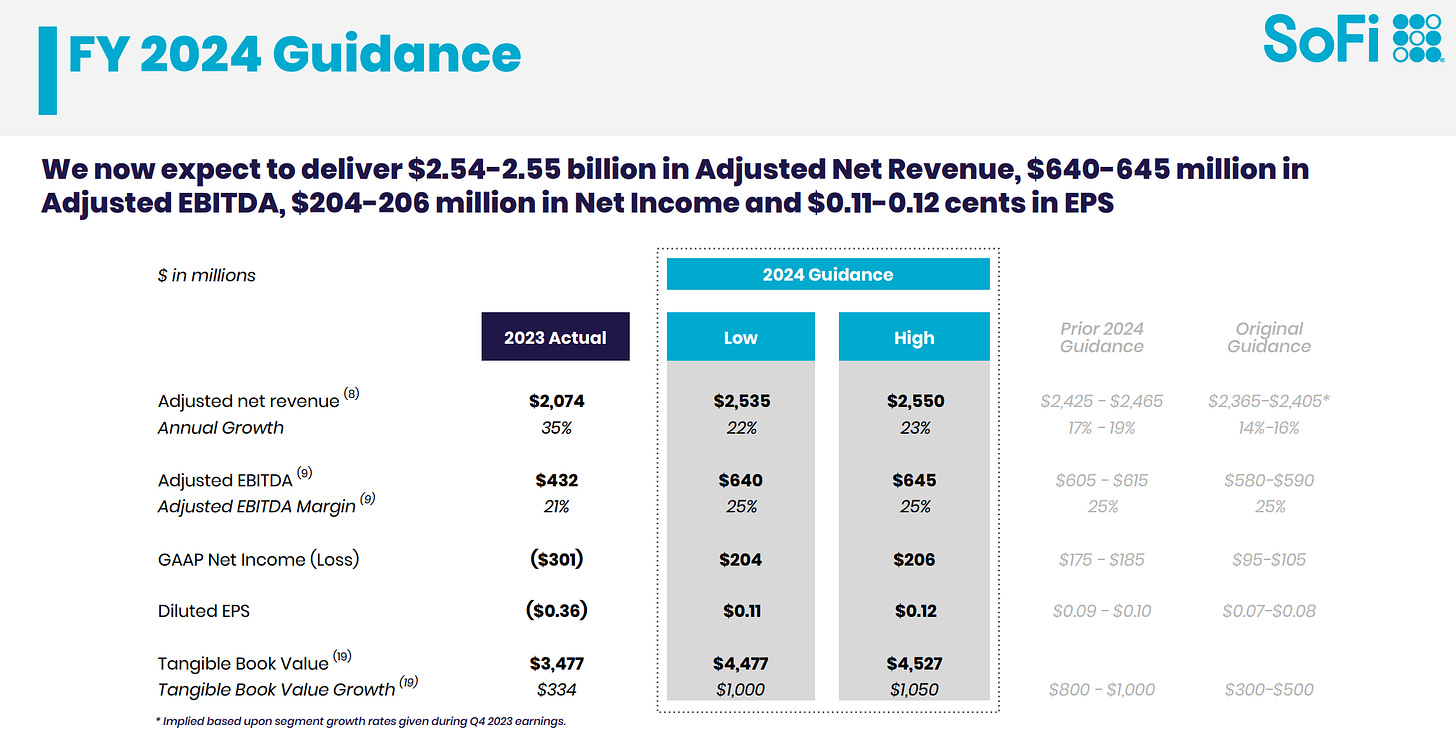

Here’s their guidance for 24

They are remarkably well-positioned for continued growth.

Analysts forecast revenue to grow by an average of 13% annually over the next three years, compared to an 11% growth forecast for the Consumer Finance.

With a solid foundation, diverse product offerings, and a growing user base, I believe the company is primed to capture a larger and larger share of the fintech market.

Their initial move from $6 to $11 is just the beginning, and while I think $16 is in the near term horizon, I think they’ll be well north of $20 and $30 in the years to come.

I hope you have enjoyed this brief yet informative update.

Happy hunting!