Take-Two Interactive: The Next Big Play in Gaming

Exploring the Industry Trends, Strategic Moves, and Huge Potential

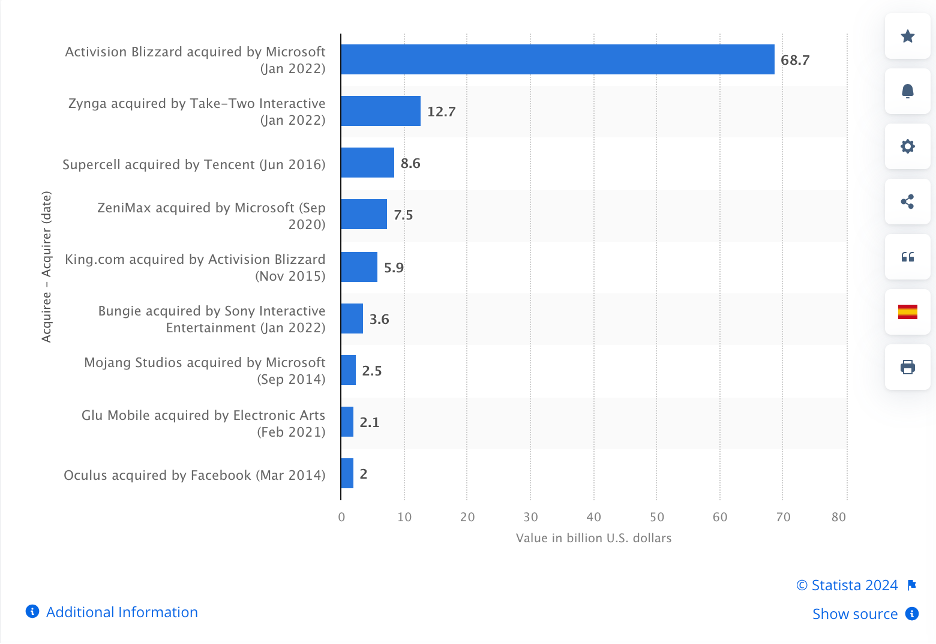

When Microsoft acquired Activision Blizzard for $75 billion in 2023, it sent shockwaves through the gaming industry.

The deal wasn’t just a major financial move, it was a declaration of how serious Microsoft is about dominating the gaming space.

At the time of the announcement in 2021, Activision Blizzard reported annual revenues of $8.8 billion and a net income of $2.7 billion.

These figures underscored its position as a major player in the industry, thanks to games like Call of Duty, World of Warcraft, and Candy Crush.

Microsoft paid a premium price of nearly 8.5x Activision’s annual revenue and 28x its net income, a clear reflection of the value found in their IP, user base, and potential to shape the future of gaming.

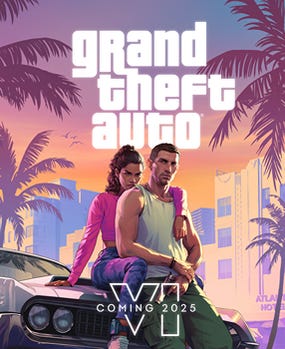

Now, let’s consider Take Two Interactive, the company behind Grand Theft Auto, Red Dead Redemption, and NBA 2K. TTWO 0.00%↑

1 year chart:

For the fiscal year ending March 2024, TTWO reported revenues of $5.35 billion.

While this trails Activision Blizzard’s 2021 figures, it’s still enough to place TTWO among the industry's elite.

However, unlike Activision’s profitability, Take Two posted a net loss of $1.125 billion, primarily due to write-downs and impairment charges related to acquisitions and unreleased titles.

Not “real” losses though… as far as I’m concerned.

Despite this, the recurring revenue from its core franchises highlights its resilience and future potential, and once this turns around, will become a game changer.

I first took a position in TTWO back in January, 2023 at $105 and change, so while I’m biased, I still do think it’s a good buy.

Here’s why.

Gaming has always been a passion of mine, going back to the time my mom tried to limit me to 40 hours a week of gaming in the 8th grade.

Apparently, waking up at 4 AM before school to game and spending all weekend in front of a screen wasn’t exactly normal behavior.

These days, my love for gaming has evolved into a love for spotting gaming trends and turning those insights into profitable investments.

And TTWO just might be next on my radar for

subscribers!On a chart, and we all know I like to time my fundamental picks with technical entry points, is looking prime for a break out. I think.

The previous peaks of $194 in 2021 and $210 prior provide key resistance levels.

Once we see the stock breaks through there, I see strong upside potential into the $250’s and 300’s.

Next up, the gaming industry is undergoing rapid consolidation.

And companies like Microsoft are making bold moves, bringing their games to other platforms to achieve broader adoption.

This shows the strategy is clear: owning the content is more important than owning the platform.

Think of it like how Netflix and Apple are investing heavily in creating their own movies and shows - it’s the content that drives value. And the value is what gets you acquired.

Amazon’s rumored interest in entering gaming via acquisition, rather than building from scratch, makes TTWO a prime target.

With a market cap of $32 billion, TTWO is still significantly smaller than Activision was when Microsoft acquired it for $75 billion.

To me, this makes TTWO an attractive yet affordable target.

What’s really crazy though, to me, is how rapidly the model is changing.

Gaming companies are transitioning from one-time game sales to recurring revenue models.

Here are a few key trends:

Subscription Services & Game Pass Models: Platforms like Xbox Game Pass, PlayStation Plus, and EA Play are offering libraries of games for a monthly fee, creating predictable revenue streams.

In-Game Purchases & Microtransactions: Transparent systems like battle passes have replaced loot boxes, driving player trust and steady revenue. Cosmetic upgrades remain a major monetization layer.

Free-to-Play Models: Games like Fortnite have proven the success of free-to-play titles that monetize through microtransactions and ads.

Metaverse Integration: Virtual economies and in-game sponsorships are adding new dimensions to revenue generation.

Now, combine all of that with TTWO’s release radar, of which by the end of 2025, they plan to release:

Borderlands 4

Mafia: The Old Country, and

The highly anticipated Grand Theft Auto 6

And more, but these are the ones I’m excited about.

Just the announcement alone of GTA 6 in 2023 caused TTWO’s stock to jump 6.6%.

With GTA 5 selling over 185 million copies and generating $7.7 billion in revenue since its release, the potential for GTA 6 to surpass these figures is monumental.

I expect these titles to generate over $10 billion in revenue for Take Two alone…

Going back to Microsoft’s acquisition of Activision, if we apply a similar revenue multiple of 8.5x to Take Two, the valuation would land at approximately $45.5 billion.

That’s significantly higher than its current market cap of $32 billion.

A valuation of $45.5 billion would translate to a stock price north of $256.

Even with Take Two’s current lack of profitability, which is mostly one time events, its library of gaming franchises and anticipated growth in recurring revenue, to me, justify a premium valuation, over that above number.

The anticipated release of GTA 6 alone makes this an undervalued asset in today’s market.

It is my belief that the gaming industry’s shift toward live-service games, subscription models, and metaverse integration which places TTWO in a prime position.

Its strong intellectual property portfolio, combined with its ability to monetize through DLC, microtransactions, and esports, makes it a ripe acquisition target for tech giants looking to expand their footprint like Amazon.

With consolidation reducing competition, revenue streams expanding, and TTWO’s epic pipeline, I’m quite confident in its long-term potential, and short term as well, as we head into 2025.

For anyone looking to ride the wave, my money is on TTWO. I’ll follow this up in the new year and see how we do.

Happy Hunting!