SOFI on the Rise: A Hidden Gem Poised for Growth in 2024

Exploring SoFi's Recent Surge, Financial Strength, and Future Potential

In an interview last month with

, Bill and I discussed some of my top picks and predictions for the rest of 2024.One of my top picks was SOFI. We were trading at $6.15 ($6.52 when published), then it started to move closer to $7.50, and over $8.00, for a short period in the weeks following.

Here’s an excerpt:

Quick Overview: SoFi is an online bank that offers student loans, mortgages, and other financial products. Its online-only nature — SoFi doesn't have physical bank branches — is a massive cost-saver. So it’s able to charge lower fees and offer higher interest rates.

One “dark cloud” narrative that’s loomed large has been SoFi’s over-reliance on student loan revenue. SoFi claimed it lost $300 million to $400 million in refinancing revenue and $150 million to $200 million in profits between March 2020 and March 2023 because of student loan forgiveness.

The company has also continuously lost money since going public in 2021; it recorded its first profitable quarter at the end of 2023.

Of course, it’s the “what comes next” that matters most.

While I think SOFI is a fantastic pick and heading to $10.00 by year end, I was skeptical of the summer doldrums and wanted to try my best to be patient and pick the optimal entry point.

With this recent pullback in the last 48 hours, that patience may have run out and it will be hard to ignore.

I believe that entry point is closer than ever, especially with this triple earnings beat.

Watch this video to find out why:

SoFi Technologies, a member-centric, one-stop shop for digital financial services and one of my favorite stocks to own, reported their financials last week.

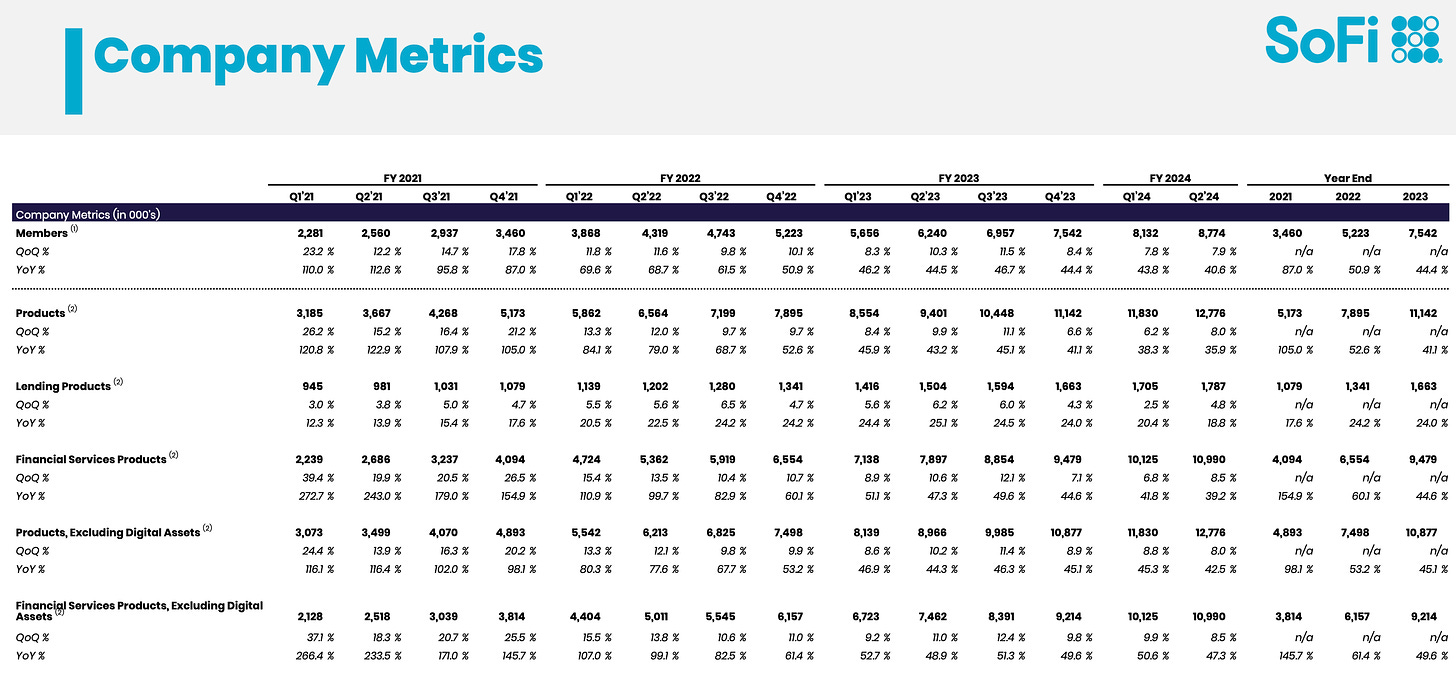

Just look at the chart below… it shows you all you need to know about their trends.

They have had fantastic growth across all areas. If you don’t know SoFi, here’s a look at all the other products offered:

“Our Financial Services and Tech Platform segments now make up a record 45% of SoFi's adjusted net revenue, up from 38% a year ago and 32% two years ago," commented the company's CEO, Anthony Noto.

SoFi Technologies reported net revenue of $599 million and net income of $17 million for Q2 2024, marking their third consecutive quarter of GAAP profitability.

This represents a 40% year-over-year increase in revenue and a significant improvement from a net loss of $47 million in the same quarter last year.

Second quarter adjusted EBITDA of $137.9 million, a 23% margin, increased 80% from the same prior year period's $76.8 million. The company's CEO, Anthony Noto, attributed the success to strong growth in SoFi's financial services and technology platform segments.

SoFi also saw a 23% increase in total members, reaching 9.7 million by the end of the quarter.

Given these factors, SoFi would need a roughly 40% increase from its current price to reach the $10.00 target.

In my view, this is achievable if the company maintains its growth trajectory and market conditions are supportive.

Investing in SoFi now feels like planting a tree in fertile soil; it has the potential to grow strong and tall, given the right conditions. Watch the video above, and let’s continue this exciting journey together!

This may just become one of my “Danny’s Double’s” stock picks.

Happy Hunting!