Debt Mountain or Financial Freedom? Lessons from Norway's Oil Boom

How Strategic Resource Management Could Transform America's Fiscal Future

I watched an intriguing interview with Kevin O’Leary the other day, and it sparked a whirlwind of thoughts.

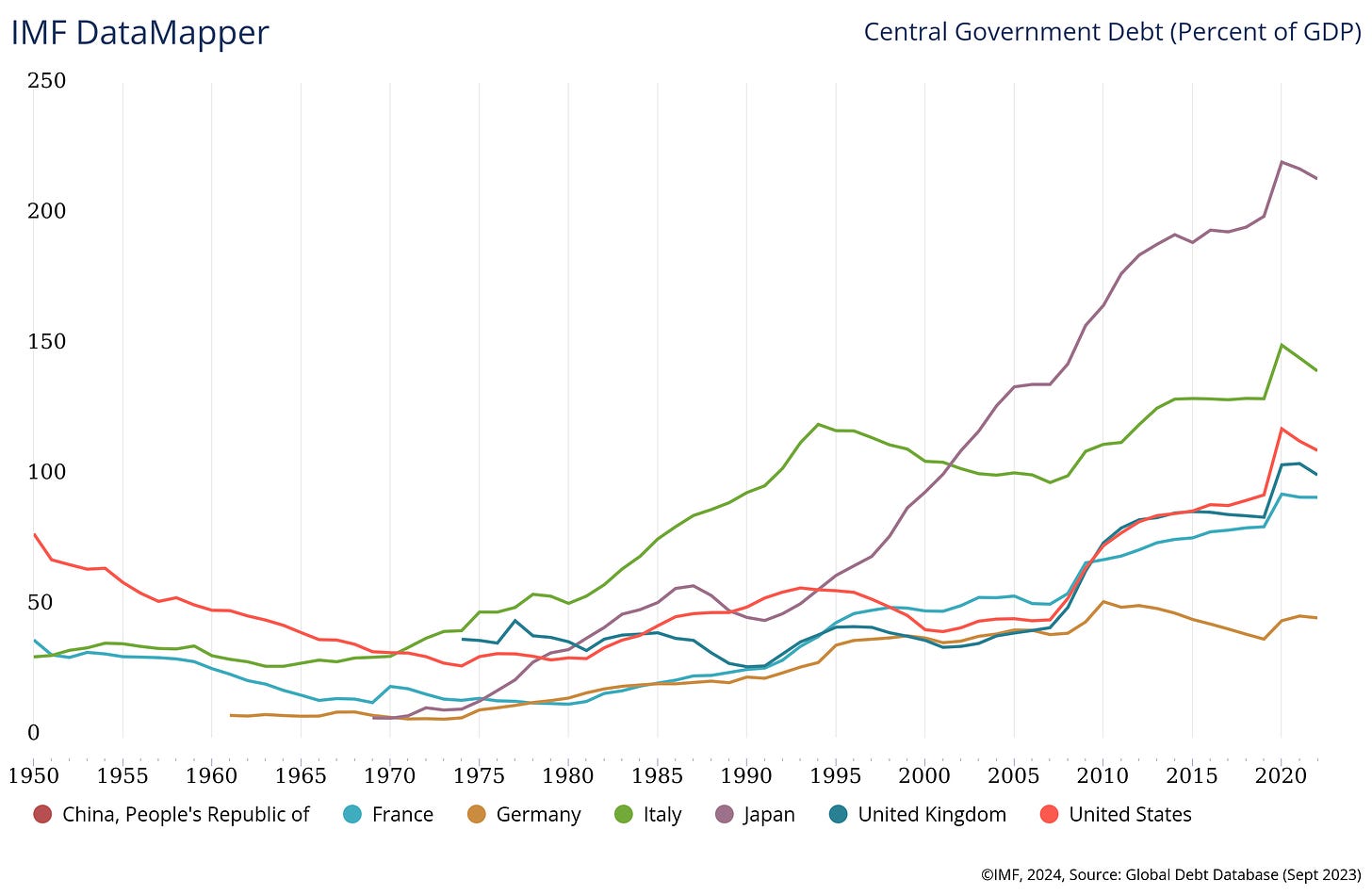

We have record debt across the United States, which is no surprise. Although it’s not as high as in some other countries relative to their GDP, it remains significant.

As of now, the U.S. government debt stands at a staggering $34.61 trillion.

The Gross Domestic Product (GDP) of the United States, which is a monetary measure of the market value of all final goods and services produced in a specific period by a country or countries, stands at $28.6 trillion. GDP is often used as a barometer to gauge the economic health of a country or region.

This means U.S. government debt is a towering 121% of GDP.

To put that into perspective:

United Kingdom: 100.75%

France: 92.15%

Germany: 45.95%

Italy: 140.57% (second highest)

Japan: 214.27% (highest)

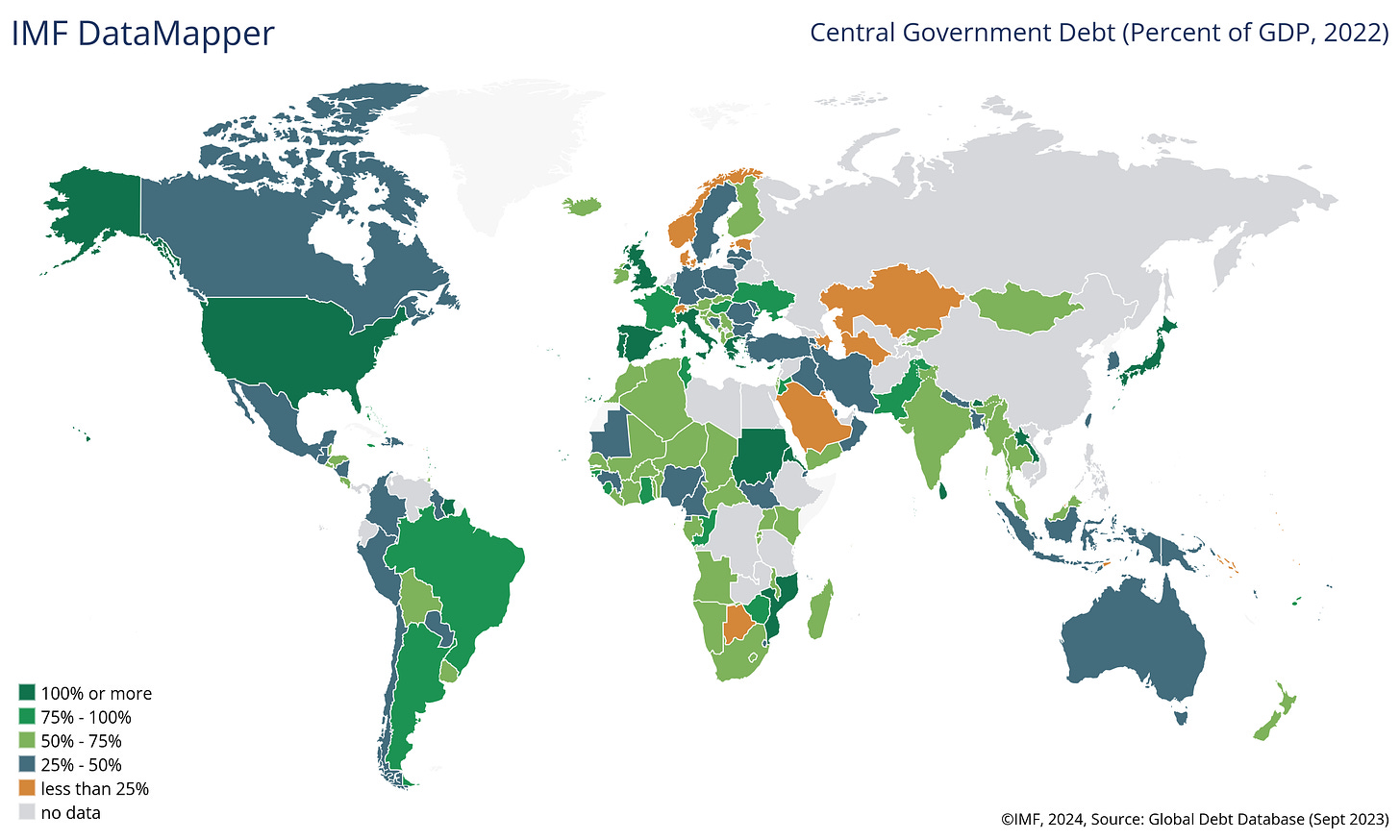

Now, let's zoom out and look at this from a global perspective.

Governments worldwide are printing money and accumulating debt like it's going out of style.

How do we address this colossal issue?

Like any deeply rooted question in life, one of the simplest ways to find answers is to revisit the past.

Let’s take a lesson from Norway

and Canada in the 1970s.

Norway struck oil in the North Sea and hit the jackpot. Instead of squandering this newfound wealth, they placed a royalty on every barrel of oil produced, channeling this revenue specifically to reduce the country’s debt.

What a concept!

They went further and established a massive endowment fund to ensure the ongoing wealth and wellness of Norway’s people, enacting ironclad laws to protect it.

Canada, however, took a different path.

They tried to mimic Norway's strategy, but due to regulations managed provincially rather than at the federal level, and political conflicts between provincial and federal governments, they squandered these resources over the next 40 years.

Strategic Use for Debt Reduction (Norway):

Debt Reduction Focus: Norway strategically used its oil revenues to reduce national debt and build financial reserves. This approach provided long-term fiscal stability and improved the country's economic resilience.

Savings for Future Generations: The establishment of the Government Pension Fund ensured that oil revenues were saved and invested for the benefit of future generations.

Mixed Use and Lack of Long-term Focus (Canada):

Provincial Spending: In Canada, provinces like Alberta used oil revenues for immediate spending on infrastructure, social programs, and economic diversification, which provided short-term benefits but did not always contribute to long-term fiscal stability.

Heritage Fund: Alberta established the Alberta Heritage Savings Trust Fund in 1976 to save a portion of oil revenues, but periodic withdrawals and lack of consistent contributions limited its impact compared to Norway's fund.

Remarkably, Canada discovered almost the same amount of oil as Norway, nearly down to the exact number of barrels, which makes this scenario even more astonishing.

For the U.S., a similar program could be a lifeline.

Imagine a program where the royalties from every barrel of oil are dedicated solely to paying off national debt, as written by Congress.

It would significantly reduce national debt.

While it sounds simple in writing, these are proven strategies that have worked historically.

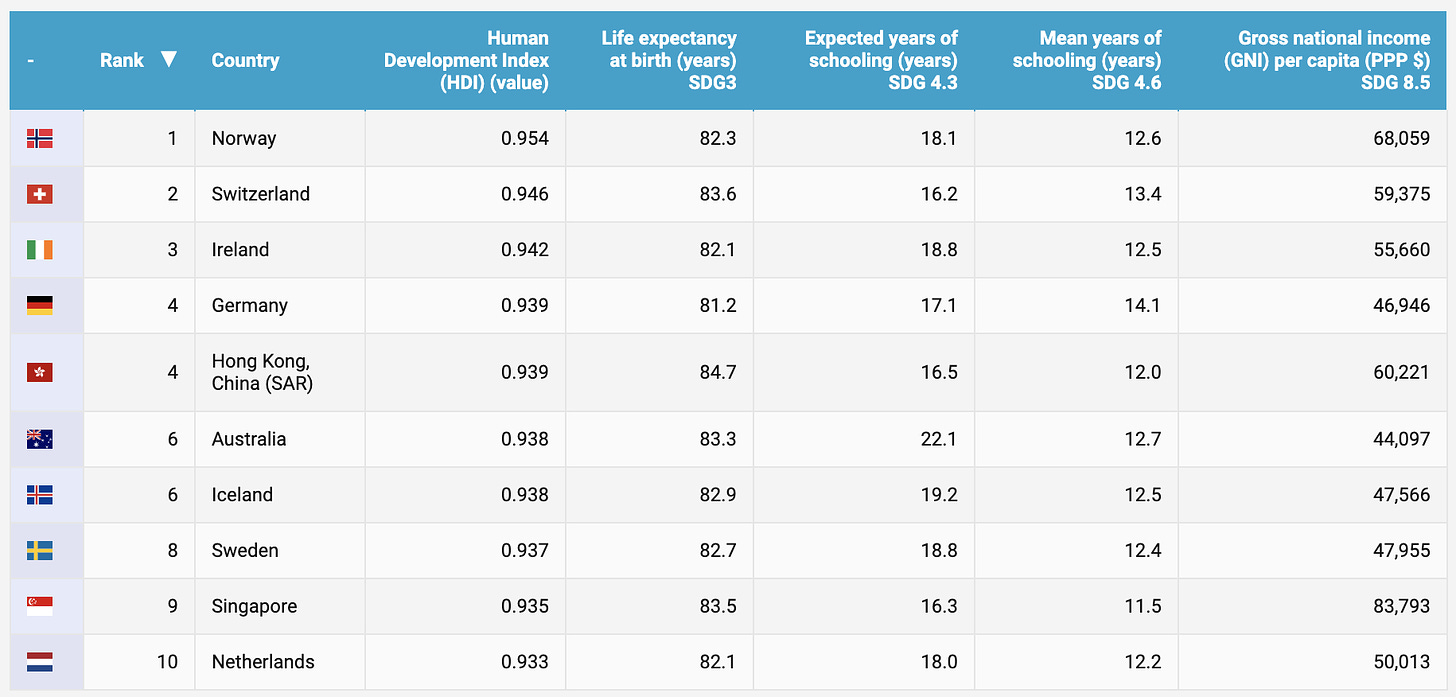

Norway boasts one of the highest qualities of life in the world.

For 15 consecutive years, the United Nations Human Development Report has ranked Norway as the best country in the world to live in. One reason for this high ranking is Norway’s investment in its citizens living long and healthy lives, resulting in a life expectancy of 82.3 years, especially impressive compared to the global average of 71.5 years.

This success is the fruit of decisions made 50 years ago regarding the taxation and royalties on their oil reserves.

These wise decisions have led not only to an enviable fiscal position for the country but also to an incredibly prosperous way of life for Norwegians.

(By the way, I’m heading to Norway for the first time in July on a Baltic Sea Cruise that I’m quite looking forward to, on one of these 100-people cruises with 100+ staff.)

Maybe I can find some interesting people to interview?

So, the burning question is, how can the U.S. now become the most self-sufficient and energy-secure countries in the world?

The answer could lie in our national energy reserves.

This potential policy could be a golden ticket for the people of America.

Will we squander this treasure trove like Canada did in the 1970s, or will we adopt prudent fiscal policies like Norway did in the 1970s?

The choice is ours!